- Article

- Innovation

- Artificial Intelligence

HSBC AI Markets: From Data to Decisions

As AI moves from pilot to production across trading and treasury, the real question isn’t whether the technology works, it’s how to make it work for treasurers. We sat down with HSBC’s Yasemin Artar to talk about where AI is already earning its keep, how clients should think about risk management, and why proprietary data and analytics are emerging as the edge.

Artificial intelligence in financial markets is no longer a theoretical talking point. For corporate treasurers and institutional investors, it is beginning to change how decisions are made, how risks are assessed, and how trades are executed.

The real question is no longer whether the technology works, but how to leverage this technology effectively.

For Yasemin Artar, Head of Corporate Sales, Europe, for Markets & Securities Services at HSBC, the areas where AI is delivering meaningful value are already clear. She points to four themes: deep research platforms, agentic assistance, predictive analytics, and workflow automation.

“In the near future, agentic AI research tools will be able to break down a complex question into actionable analysis and allow treasurers to run stress-testing strategies that used to take days in just a few minutes,” she says.

That kind of efficiency speaks to urgent needs across treasury. According to HSBC’s Corporate Risk Management Survey, 93% of finance leaders admit to experiencing losses from inaccurate cash flow forecasting in the past two years, while nearly half have indicated foreign exchange risk is the area they feel least prepared to deal with.

Against that backdrop, the demand for tools that can synthesise real-time and historical data into clear scenarios has never been sharper.

Breaking myths about autonomy

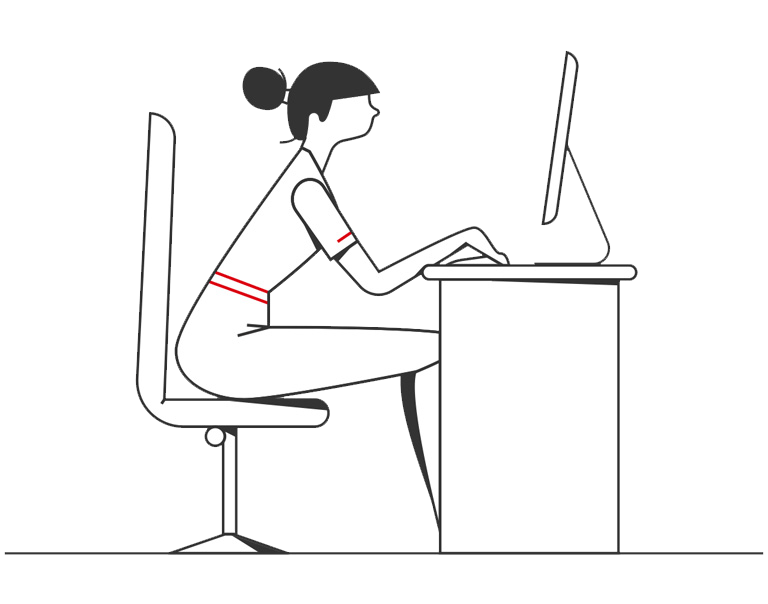

One persistent misconception, Artar explains, is that AI systems can fully replace human decision-making in markets. The reality is more nuanced. Successful use of AI requires human oversight, clear objectives, robust data quality, and the ability to interact intelligently with the system.

“People might think AI systems can be fully autonomous, do all the complex trading and address market risk challenges – but in reality, there are limitations. To successfully leverage AI, you need integration with human oversight,” she says.

Survey findings echo this. While 61% of treasurers expect AI to improve profitability, most also see its value as complementary rather than as a substitute for human judgement.

In practice, AI’s role is to handle the heavy lifting — that might be market data analysis and automating repetitive tasks — while people set the strategy and manage exceptions.

The edge lies in data

In a crowded market of AI-powered solutions, HSBC positions differentiating strength of HSBC AI Markets in its proprietary data and analytics.

Artar describes HSBC AI Markets as a natural-language gateway into HSBC’s proprietary trading intelligence and global liquidity perspective.

Traders and treasurers can pose a market question — for example, the liquidity of a particular currency pair — and receive an instant, visualised answer.

“It isn’t a generic chatbot,” she stresses. “It’s a front door into exclusive, real-time analytics powered by HSBC’s trading franchise and research across asset classes.”

The platform also extends to instant FX execution capabilities and can be accessed via HSBC’s Evolve platform or an API, with a premium tier offering risk-as-a-service.

For both institutional and corporate clients, the value is efficiency without additional IT complexity. For HSBC’s own Sales and Trading teams, it means faster synthesis of market intelligence, leaving more time for human judgement calls. And for treasuries under pressure to demonstrate strategic value, tools that turn data into potential narratives are particularly useful.

The survey found that 68% of finance leaders now see treasury as playing a key role in strategic decision-making — up significantly from 2021 — but most still describe communication with the C-suite as only “moderately effective.”

From data overload to decisions

The power of HSBC AI Markets comes into sharper focus when looking at client use cases.

Earlier this year, a large corporate needed to execute a sizeable emerging market currency transaction on the same day as a Federal Reserve rate announcement — precisely when bid-ask spreads tend to widen and liquidity often fragments.

Using HSBC AI Markets, the bank was able to fuse real-time and historical liquidity data to create a scenario-based execution plan, pinpointing the best trading windows.

The result was a large trade executed with minimal market impact, despite volatile conditions. “That’s the practical value,” says Artar. “Turning data into timing, and timing into basis-points saved.”

How corporate treasuries are adopting AI

For many corporates, AI is beginning to reshape everyday workflows. Treasurers are automating data collection and analysis, moving beyond spreadsheet-led processes in cash flow forecasting, and using natural-language interfaces to query liquidity, spreads and risk.

This shift is not about replacing people, Artar emphasises, but about improving speed, consistency and auditability while freeing teams to focus on policy and strategy.

For treasury, that translates into questions around working capital, liquidity and hedging — all areas where structured data and AI can help.

Guardrails, governance, and what’s next

As with any new technology, the conversation inevitably turns to governance.

Artar is clear that responsible AI starts with clear guardrails: explainability, robust data controls, segregation of duties, and human sign-off for higher-risk actions. Trust, she argues, is earned through daily use and reliability.

Looking ahead, she expects large language models to play a greater role in interpreting news or macro events and translating them into risk signals.

She also sees agentic AI — systems capable of undertaking multi-step tasks independently — becoming more practical, though always with human oversight and defined constraints.

Human + machine: a joint effort

The future relationship between humans and AI, Artar believes, will be increasingly collaborative. AI will take on data analysis and repetitive tasks.

Humans will remain responsible for strategy, judgement and managing exceptions. “The teams that win will be the ones that design the interface between the two — clarity on what the system is solving for, and when people should lean in,” she says.

This aligns with broader market realities. Finance leaders expect higher financing costs to remain a challenge, with many already increasing their share of fixed-rate debt.

Those structural decisions are precisely the kind of strategic calls that benefit from faster, more transparent analysis.

The bottom line

AI’s promise in markets is not abstract. It is the ability to turn overwhelming streams of data into timing, pricing and risk clarity while keeping humans firmly in the loop.

For treasurers, whose remit is broader and more strategic than it was three years ago, the challenges of forecasting errors, FX exposure and risk management remain pressing.

Tools like HSBC AI Markets cannot make those hard calls. But what they can do, when combined with strong governance, is shorten the path from question to decision, and from decision to measurable impact.

HSBC AI Markets is for existing clients. The information shown in marketing materials are for demonstration only. The Bank is not responsible for any loss, damage, or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use or reference of the information in this material. The information provided to you on HSBC AI Markets is intended only for professional sophisticated and/or eligible clients, investors or counterparties. For full disclaimers please see the HSBC AI Markets website.