- Article

- Managing Risk

- Improve Efficiency

Why companies should rethink their approach to interest rate risk

After more than a decade of ultra-low rates across developed markets, interest rates are once again a major factor in corporate cash flows. What can treasurers do to reduce the impact for their business?

Article finalised June 2023

Are companies still at risk from interest rate rises?

As central banks in Europe and the US slow their monetary tightening, companies could be forgiven for thinking that the pain caused by rising interest rates is now behind them.

That may be wishful thinking, for a few reasons.

The effect of interest rate rises on corporate finances

For one thing, changes in interest rates have a delayed effect on corporate finances. Many companies locked in fixed-rate financing before the tightening cycle began in early 2022, and will not feel the full impact of a step change in policy rates until they come to refinance those obligations.

The potentially large risk tied to higher interest rates became evident in the US banking sector earlier this year, when lenders – most publicly Silicon Valley Bank – were forced to book heavy losses on unhedged portfolios of long-duration bond assets. While corporates usually won’t face a similar fair value risk, most will have felt an increase in interest expense both in 2022 and to a larger scale in 2023.

Central banks can still raise rates in response to price increases

Further inflation shocks and longer or higher peak rates are also still possible. While the consensus view is that interest rates will reach a peak soon, a renewed acceleration in price rises could force central banks to raise policy rates even further in response.

On the other hand, an economic slowdown would complicate the picture further. With a potential recession looming, companies would understandably be reluctant to lock in today’s rates if borrowing costs are about to head lower.

What is interest rate risk?

While the direction of interest rates is as uncertain as ever, the pace of monetary tightening over the past year has shown the damage that unhedged liabilities can do to corporate cash flows.

It’s prudent, then, for companies to think about rate risk as part of their ongoing treasury management. With the right strategy, they can mitigate the impact of any undesired surprises.

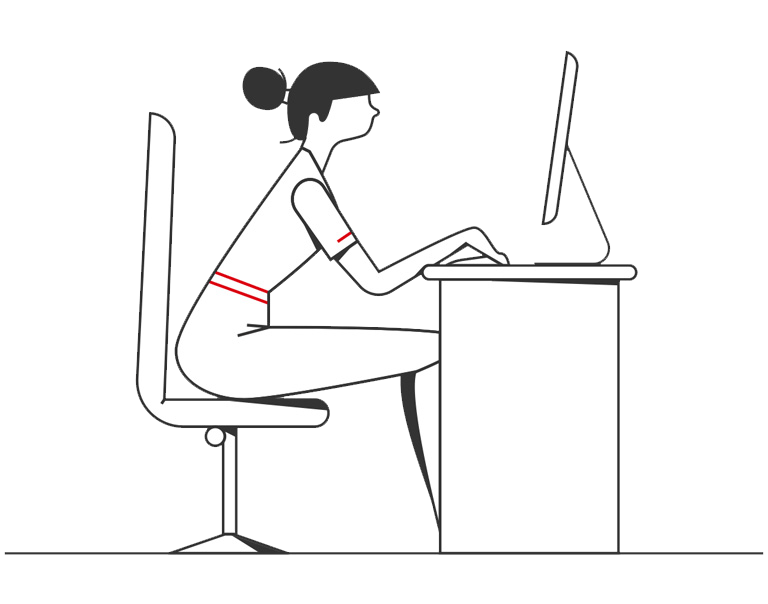

Margin control and predicting cash flows and becomes difficult

Ultimately, interest rate uncertainty makes it harder for corporates to predict their cash flows and control their margins.

Rising interest rate impact on project funding

Rising rates can make some projects unviable because the revenues they will produce will no longer be able to cover the cost of funding. Sectors struggling more than others include those where operating businesses were hit first by the pandemic and then the recent inflationary shocks - and where those higher input costs cannot be immediately passed on to customers. Non-exhaustive examples include automotive suppliers, low-margin textile producers and real estate developers.

These concerns are not new: CFOs’ answers to HSBC’s Rethinking Treasury survey back in 2021 suggested an early awareness of interest rate risk set to make a comeback. But taking action has frequently lagged such awareness – especially as decision-makers who have entered treasury management after the global financial crisis had never even faced such challenges in their careers before.

Companies need to re-evaluate how they manage interest rate risk

In the current environment – after 10 increases to US dollar policy rates of cumulative 5.00% in just 14 months – all companies face important questions as to how they manage interest rate risk in the new environment, both for the short and longer term. This is the case whether they finance themselves largely via loans and other typically floating-rate instruments, or via the capital markets and therefore mainly fixed-rate funding.

Companies that are financed through loans and floating rate instruments

For the former group, the speed of interest rate hikes has posed cash flow risk, as they have to cover higher interest costs, negatively affecting their financial ratios and potential loan covenants. Many might regret not having locked in fixed rates because their decision-making process was too slow. Their key concern now is often about how much protection they may need against rates rising further while also minimising the risk of locking in what in hindsight might turn out to be an unfavourable rate.

Companies that have more fixed-rate exposure

For companies with more fixed-rate exposure, the impact is mainly materializing over upcoming debt maturities and the rates at which the current debt portfolio will be refinanced. A particular challenge for them in the current environment is to potentially adjust their share of fixed-rate and floating-rate debt downwards while the interest rate curve is inverted. That means the cost of floating-rate funding is now higher than for fixed rates, which has not been the typical environment for most of the past 50 years.

How to mitigate interest rate risk

While corporate treasurers generally know they need to respond to this new reality, the big question is how they do so. While the consensus is that rate rises are close to peaking and the next major move will be down, there is no guarantee that will be the case nor clear central bank signals when it will happen.

1. Consider buying an interest rate cap

For the short to medium term, one general theme amid the uncertainty has been a greater openness from corporates to discuss optionality. For instance, many are now willing to consider buying an interest rate cap, which limits the maximum interest cost for floating-rate exposures. This solution would therefore take action to address an imminent risk while not locking in what might look like onerous interest expenses in a year or two.

2. Implement a framework to manage the risk

That might be considered sensible, but CFOs and treasurers also should take a broader and longer-term view. From our discussion we are observing a greater focus on making sure there is a framework to manage interest rate risk either being put in place or being updated. Certain larger corporates have implemented policies that allow them to change the mix between fixed- and floating-rate financing in a relatively wide range – empowering the treasury department to act quickly when economic variables change.

Before that the first priority for any corporate treasurer is to understand the tools available to them in today’s market. We support our clients with a variety of training sessions and workshops on interest rate risk management, particularly for those who may not be accustomed to dealing with interest rate products.

3. Use data to assess the interest rate impact on your KPIs

Data is also key to informed decisions. This can include to look to times when the rates curve was previously inverted, such as during the oil crisis in the 1970s. We support clients both with such backtesting as well as with a forward-looking risk quantification via value-at-risk analytics to help them assess the potential impact of today’s decisions on their KPIs.

4. Analyse interest rate movements across all markets you operate in

For clients who utilise financing in various parts of the world – whether in emerging or developed markets – they need to be aware of interest rate dynamics in multiple markets with vastly different macroeconomic profiles. Here HSBC can throw the tremendous value of its global network into the conversation – being able to provide relevant information and execute the risk management solutions chosen by our clients across the world.

5. Align to your company's sustainability targets

Finally, a growing range of financing instruments includes clauses linked to our clients’ sustainability targets. In many cases those targets can be mirrored in hedging solution to allow companies to align their ESG strategy across financing and treasury operations.

Ultimately, the need to make adjustments comes down to the assessment of the individual company’s risk capacity – with interest rate derivatives like swaps, caps or swaptions being available to transfer the risk profile efficiently. After the past 18 months have handed corporate treasurers a painful reminder of interest rate risk, they should ensure they are better prepared for it in the future. HSBC strives to be their partner on this journey and our teams are looking forward to the next conversation